When the COVID-19 pandemic rocked the world in 2020, the state of the Real Estate market became the talk of the town. The Coronavirus has had profound impacts on the housing market, to say the least. Since 2020 we have seen some ground-breaking records set, and also experienced the impacts of the fight against inflation. So, here’s the breakdown.

2021 – The Unicorn Year

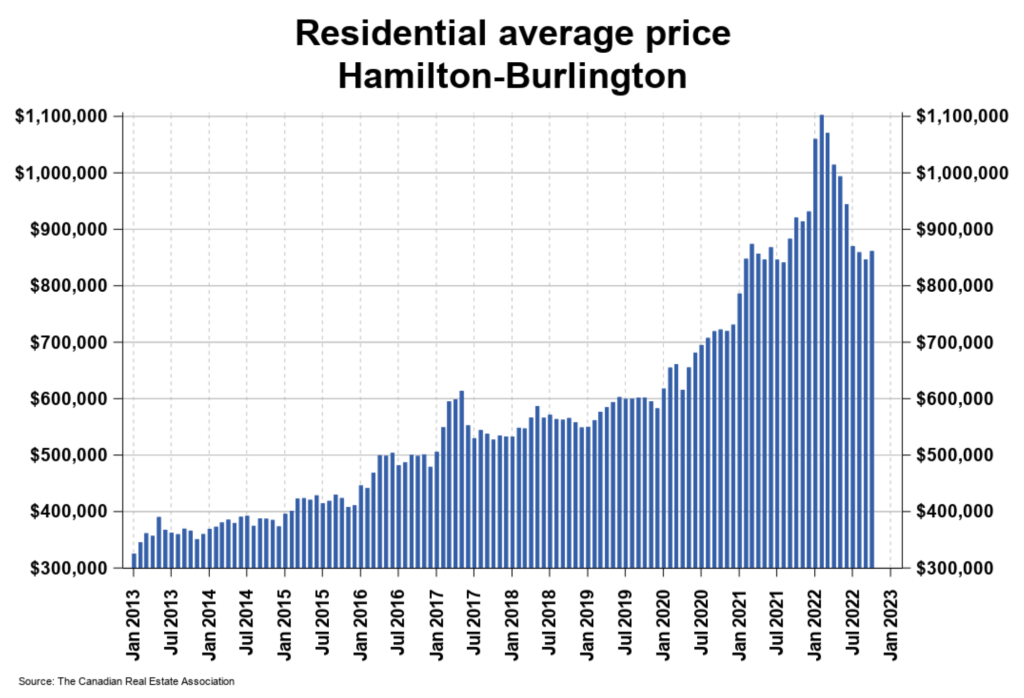

2021 was the perfect storm for the Hamilton-Burlington Real Estate market. The extreme lack of inventory led to rapid price growth, resulting in 1 of every 4 transactions being $1,000,000 or greater. This was a substantial increase compared to 2020 where only 1 of every 10 transactions fell into that price category. The 2021 market had a feverish momentum fueled by high demand and supported by historically low mortgage rates. This led to new records being recorded month after month. But here’s the thing about unicorns… they are highly desirable but very rare.

2022 – The Year the Government Fought Inflation

2022 started off with a bang. With the Omicron wave forcing Ontarians back into a lockdown situation, policymakers were forced to push back on the plans to increase rates and borrowing money remained cheap. This sent home prices skyrocketing and set the record for the highest average sales price in the Hamilton-Burlington market of $1,104,163 in February.

The Bank of Canada began raising interest rates in March in an aggressive campaign to fight inflation in the overheated Canadian economy. On Wednesday, December 7th, they made their 7th and final interest rate hike of 2022 bringing the policy interest rate from 0.25% in March to a current 4.25%.

For the moment, sale prices continue to trend down from the peak levels reported earlier this year. It is important to note that while shifting conditions have caused prices to trend down from peak, the pace of monthly decline has eased over the past several months. Overall, residential prices are still significantly above levels reported prior to the pandemic.

2023 – The Balancing Act

In a sharp contrast to 2021 & 2022, we are expected to experience more balanced conditions in 2023. This trend is already starting to materialize in the Hamilton-Burlington market as a result of the current economic conditions. This is a much-needed adjustment from the unsustainable price increases and demand that we experienced in early 2022.

With the GTA being Canada’s largest urban centre, our market in particular has been feeling the effects of the feverish demand and shortage of housing, resulting in unsustainable price growth and spiralling unaffordability. While recent price adjustments and continuing softening of the market may be hard to swallow for some, what we are experiencing is a return to much more “normal” market conditions. This will allow for more choice and negotiation power for buyers and levels will become more consistent with long-term trends.